Cryptocurrency prices are influenced by a variety of factors, and their highly volatile nature can lead to significant fluctuations. Here are some of the key factors that can cause changes in cryptocurrency prices:

1- Market Demand and Supply

Like any other asset, the prices of cryptocurrencies are primarily determined by the forces of demand and supply. If there is more buying pressure (demand) than selling pressure (supply), the price tends to rise, and vice versa. The demand for a cryptocurrency asset can be from variable sources. Some cryptocurrencies like ETH are used to pay for gas fees on transactions on their blockchains. These assets are usually called coins instead of tokens. As long as more and more people transact on these blockchains, the demand for their coins is likely to increase. There are many coins on the market but see below some of the most popular.

On the contrary, a cryptocurrency with less utility could experience less demand. We can find in that category many tokens usually used on smart contracts have no use cases to offer. Their price action is most often driven by speculation and sentiment.

Is it necessary to also state that most meme coins have no utility? I guess you get the point.😉

2- Speculation and Sentiment

Cryptocurrencies are often subject to speculative trading, where investors buy and sell based on their expectations of future price movements. Positive news, regulatory developments, or general market sentiment can lead to increased speculation and price movements.

Social media play in big role in speculation and sentiment, with Twitter being one of the favorite platforms for crypto investors. Be careful, most of those so-called Crypto Influencers are not really working for you. Their goal is to create enough FOMO (Fear Of Missing Out) on any assets to pump the price. They will then dump on you, taking profits and leaving you with the losses.

3- Technological Developments

The underlying technology of a cryptocurrency can have a significant impact on its price. Upgrades, new features, and improvements to security and scalability can boost confidence in a project, leading to higher prices. The better way to keep up with your favorite cryptocurrency technological developments news is to check their Twitter or their blog if they have one. It is always wise to be informed in the crypto space. It helps give you an advantage and make good investment decisions.

To help you sort out good projects from bad ones, pay attention to how the team is fulfilling its roadmap. Good projects will always try to stay on track no matter the market condition. There is a good saying that states: “Good projects are usually built in a bear market”.

4- Adoption and Use Cases

The more practical and widespread the use cases for a particular cryptocurrency, the more likely it is to gain value. Increased adoption by businesses and individuals can lead to higher demand and subsequently drive up the price.

You can see how adoption play out with Bitcoin price appreciation throughout its history. Can you believe 1 BTC was less than a dollar when Satoshi launched it in 2009? As more and more traders and institutions are adopting it, it price never stopped appreciating over the years. From June2011 to July 2023, it price has increase 48,341,051%. From $0.06 to $29,880! If you had invested $60 in June 2011, you would have $2,988,000 today!!!

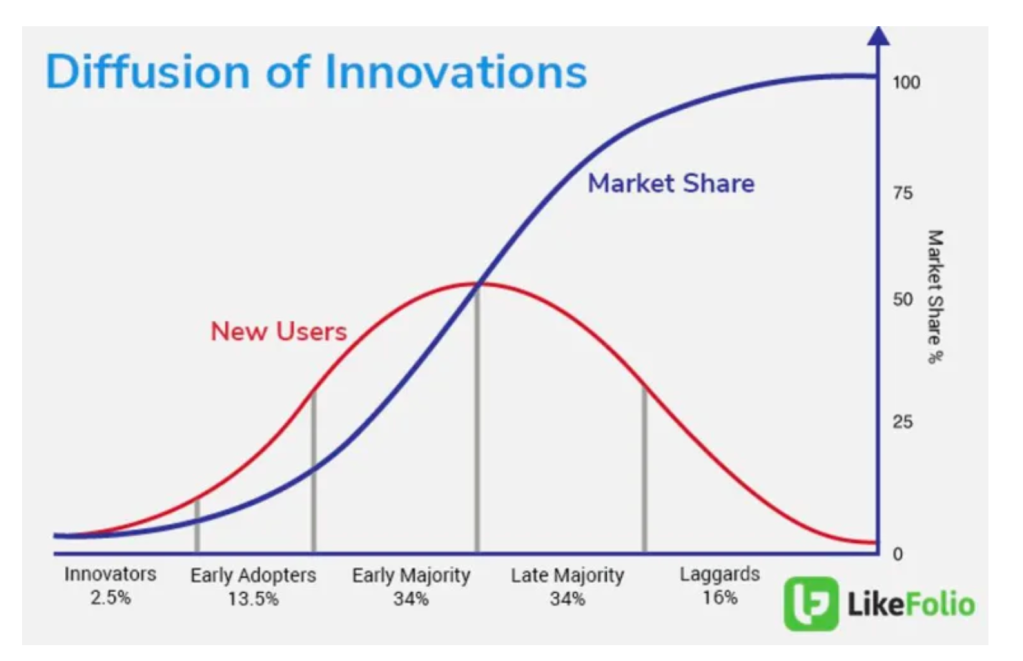

As you can see from the figure below, innovators and early adopters make the most profits in new innovation launched. More risk, more rewards!

I feel like Bitcoin and cryptocurrencies are still in the early adopters stage because the average people still don’t trade it or even know it. Only time will tell if I’m wrong.

5- Regulatory Environment

Government regulations and policies concerning cryptocurrencies can have both positive and negative effects on their prices. Favorable regulations can encourage adoption and investment, while unfavorable regulations can create uncertainty and negatively impact prices.

Cryptocurrencies have been the target of regulatory scrutiny since they first emerged in the global economy. Many countries still don’t know what they are. Are they security or commodity? Or whenever they want to call them. One thing is sure, governments don’t like them because they compete against fiat currencies. Think of cryptocurrencies as the internet of money. Like the internet, cryptocurrency assets decentralize money. Challenging the monopoly the government has long enjoyed.

6- Economic Factors

Global economic conditions can influence cryptocurrency prices. For example, during times of economic uncertainty or political instability, some investors may turn to cryptocurrencies as a hedge against traditional markets, leading to increased demand.

It’s important to note that economic cycles are a natural part of any market-driven economy. They are influenced by various internal and external factors, including consumer behavior, business investments, government policies, international trade, and technological advancements. Economic cycles are not entirely predictable, and their duration and severity can vary from one cycle to another.

As an investor, you can use economic factors as an investment opportunity. Investing when the price goes down may not make you feel good, but you will likely make more gains when price will go back up. The bear market could be your best opportunity because sooner or later the bull market will be back.

7- Media Coverage

Positive or negative media coverage can significantly influence investor sentiment and, consequently, the price of a cryptocurrency.

On May 12, 2021; Billionaire Elon Musk tweeted negative comment regarding Bitcoin energy consumption. As you may, the market reacted by selling off BTC and other crypto assets.

On May 17, Musk said that Tesla has not sold bitcoin recently, which seemed to halt the drop and keep prices roughly around $45,000.

8- Market Liquidity

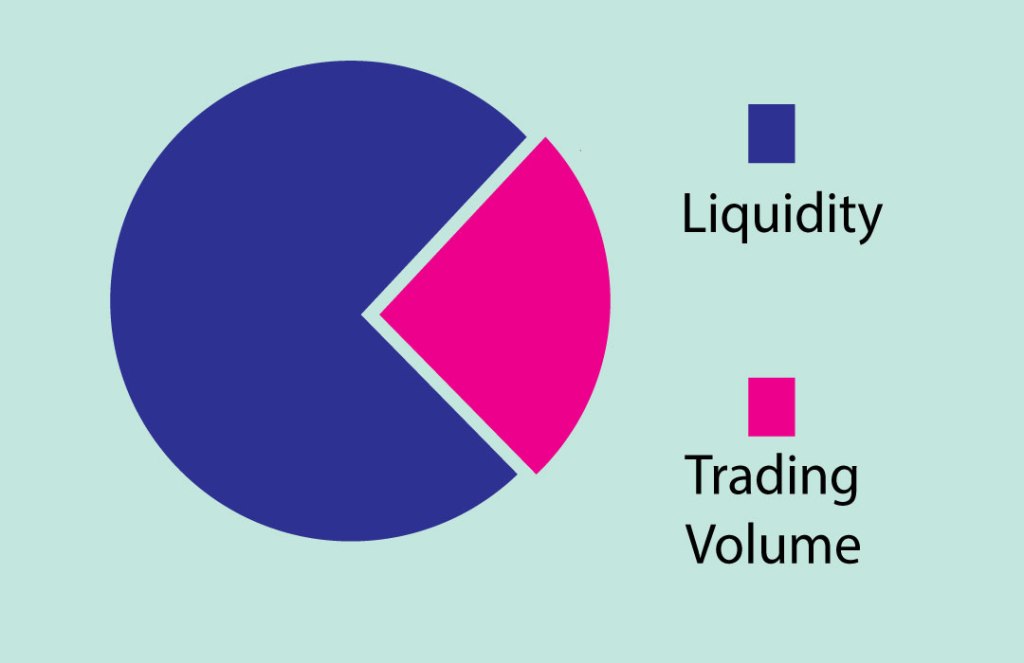

The liquidity of a cryptocurrency market can impact price movements. Illiquid markets are more prone to extreme price swings due to relatively small buy or sell orders causing significant price changes.

You can learn more on liquidity on this this previous blog post.

9- Market Manipulation

Cryptocurrency markets, particularly those with low liquidity, can be susceptible to price manipulation by large players or “whales.” Manipulative practices like pump-and-dump schemes can lead to sudden price spikes and crashes.

10- Technological Vulnerabilities

Security breaches or technical flaws in a cryptocurrency’s protocol can erode investor confidence and lead to price declines.

It’s essential to note that cryptocurrencies, as an emerging asset class, can be subject to rapid and sometimes unpredictable changes due to their unique characteristics and the evolving landscape of blockchain technology and digital finance. As a result, investors should exercise caution and conduct thorough research before participating in the cryptocurrency market.

We are dedicated to providing you materials that could add value to our visitor’s knowledge of cryptocurrencies.

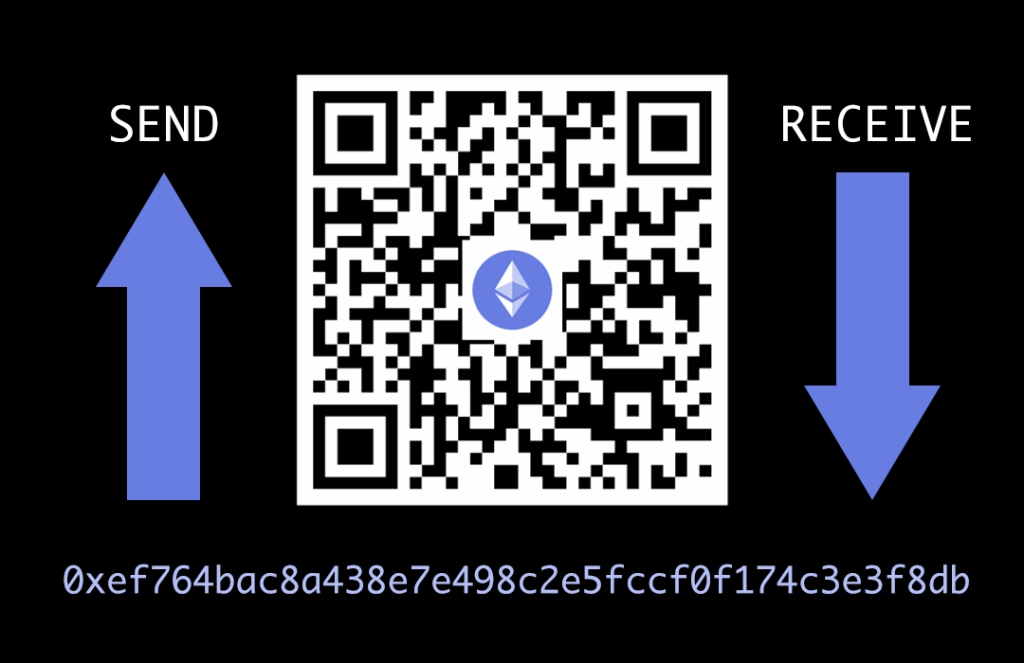

Any donation will be appreciated!

Make a one-time donation

Your contribution is appreciated.

DonateMake a monthly donation

Your contribution is appreciated.

Donate monthlyMake a yearly donation

Your contribution is appreciated.

Donate yearly

Leave a comment